Canada

Skyrocketing real estate prices spill over to suburban areas and small cities

April 14, 2021 | By Rida Khan

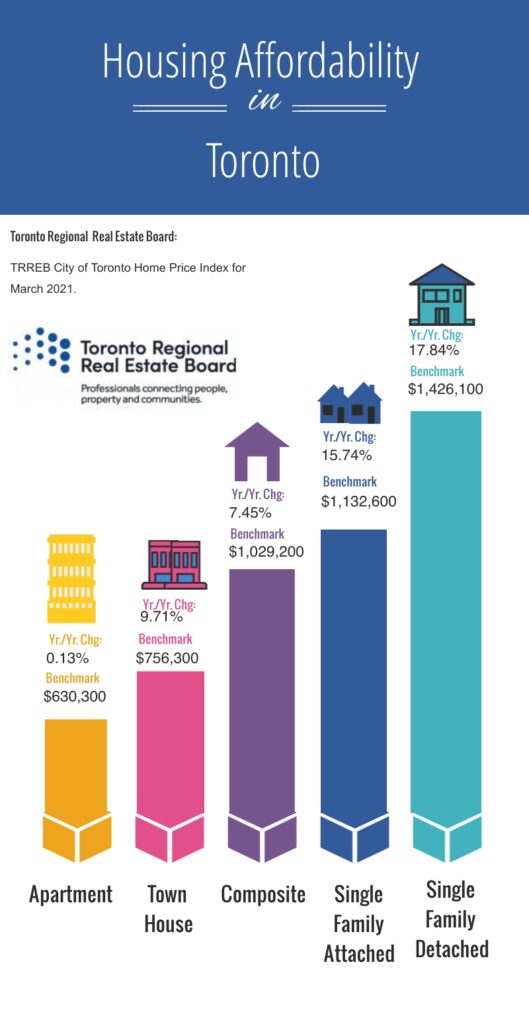

The average price of a home in the Toronto region has crossed the million-dollar mark and prices all over the country have surged as well. Work-from-home policies due to COVID-19, low-interest mortgages and lack of control by policymakers have sent the already skyrocketing property market to reach new highs.

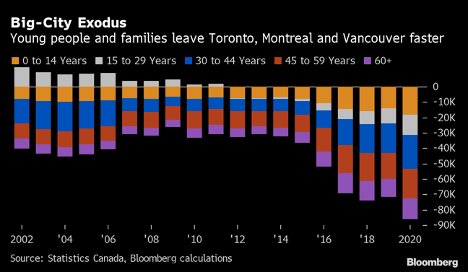

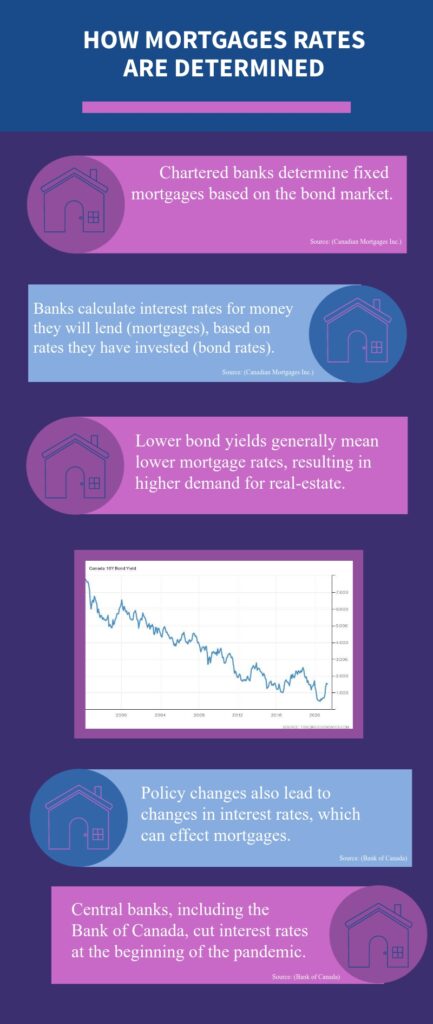

According to the Wall Street Journal, housing price increases have long outstripped income increases in Canada. Due to historically low mortgage lending rates and a trend to move away from larger cities, higher housing demands are leading to a spike in the already rising property prices. This trend was previously limited to urban and central cities such as Toronto and Montreal but is now moving to small towns and suburbs due to work-from-home policies.

What a house is worth now has less to do with how many bedrooms it has or whether it’s near a good school and more to do with what someone is willing to pay.

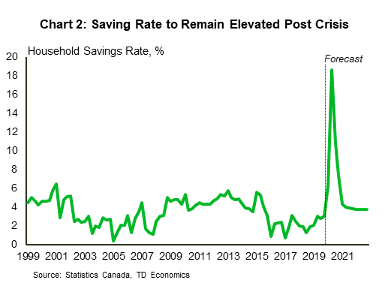

According to DHEA records, over the past year, due to limited economic activity during the pandemic lockdowns, middle-income earners moved from a net dissaving to a net saving position—the first time since 1999. The highest income earners also saw a net gain of $207 billion since the first quarter of 2020. As for the lower-income earners and younger households, they have acquired mortgage debt at a faster pace than other households, encouraged by dramatically reduced mortgage lending rates. Now with low-interest mortgages, the fear-of-missing-out mentality has resulted in housing sales increasing.

According to a poll conducted by the Bank of Montreal (BMO), 41% of people are thinking of buying a home sooner than later, as the majority (61%) believe that home values will go up in the near future. Lower-income earners and younger households have acquired mortgage debt at a faster pace than other households, encouraged by dramatically reduced mortgage lending rates.

Another BMO study predicts that 62% of Canadians say that most people will be priced out of the housing market in the next decade. 12 major housing markets have posted price gains of more than 30%, according to data from the Canadian Real Estate Association.

This is not a sustainable pattern but most stakeholders in the real estate industry, financial services, and policy-makers are not keen on implementing policies to counter this. Many of the policies being proposed by economists take long periods to implement. The market is a complex mix of income, supply and demand. It is closely linked to many other major markets and touching it directly translates into a huge spillover. There is no one-policy-fix-all solution.

A recent report by BMO economists rated 11 cooling measures one of which is ending blind bidding. Ending bidding wars, where the winning bidder routinely pays vast sums more than the asking price, was rated as high in impact and low in complexity and spillover effect. Ontario’s Ford government reviewed real estate practices in 2019 to increase transparency but it failed to remove blind bidding.

Increasing housing supply also has limited negative spillover, unlike measures such as the Bank of Canada hiking the current low-interest rates.

Also, the government of Ottawa has shut down proposals to change capital gains tax exemptions on housing. The Office of the Superintendent of Financial Institutions is reconsidering the Stress Test for uninsured mortgages to keep more people out of the housing market and to dampen defaults when interest rates inevitably do arise.

Canada is struggling to find its way out of the COVID crisis. Getting federal, provincial and municipal governments together on a broad set of housing policies from creating affordable housing and more dense “missing middle” housing to tighter mortgage rules and changes in tax treatment, won’t be easy. However, it is essential because, according to the Financial Post, as much as a quarter of Canada’s economy is directly tied to housing.

-

Uncategorized5 years ago

Hello world!

-

COVID-195 years ago

COVID-195 years agoSoundscapes Records Closing Permanently

-

Entertainment5 years ago

Entertainment5 years agoWarner Bros. ‘Godzilla vs. Kong’ renews confidence in film industry with box office revenue

-

Entertainment5 years ago

Entertainment5 years agoEllen DeGeneres loses over 1 million viewers following an apology over toxic workplace allegations

-

Entertainment5 years ago

Entertainment5 years agoLil Nas X breaks the internet with new music video

-

International5 years ago

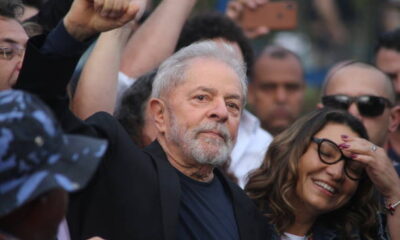

International5 years agoCorruption Convictions Annulled Against Brazil’s Ex-President

-

International5 years ago

International5 years agoThe fallout from Harry and Meghan’s bombshell interview with Oprah Winfrey

-

Entertainment5 years ago

Entertainment5 years agoLong awaited Snyder cut of Justice League is finally released