Tax Season

Navigating Tax Season as a University Student

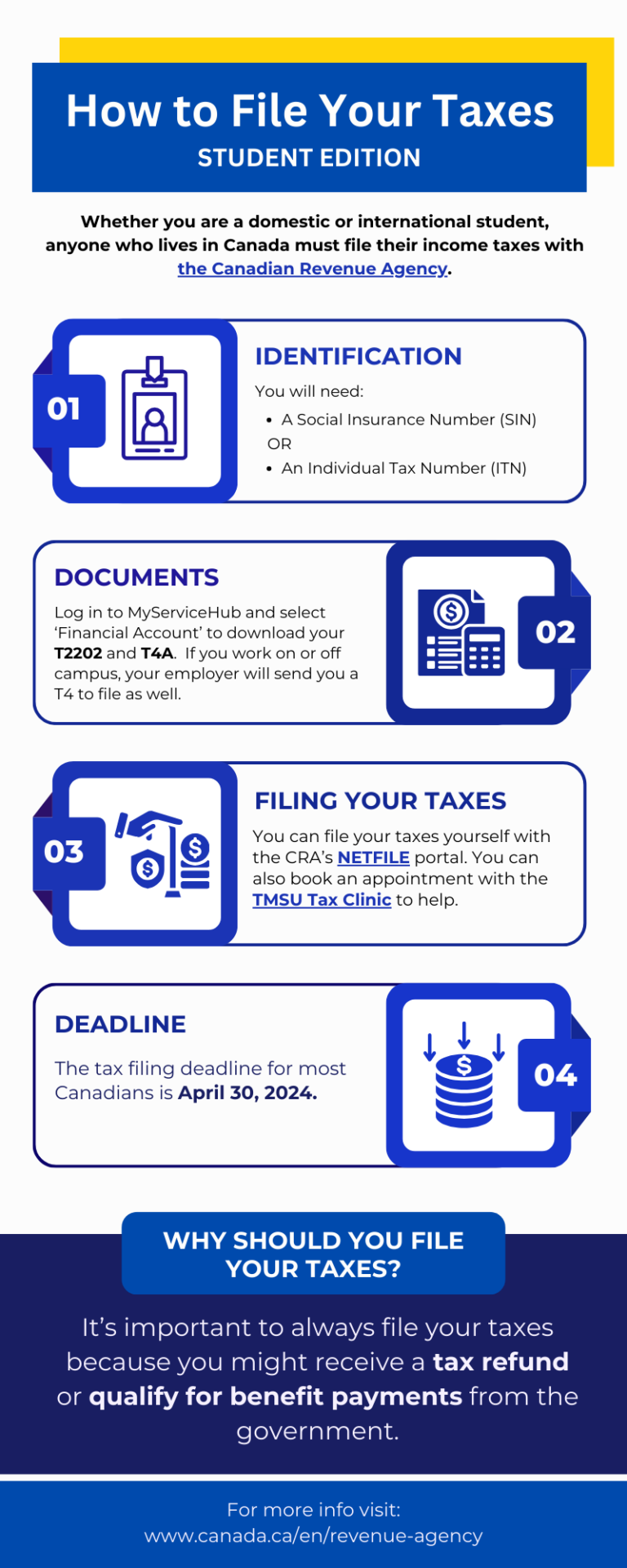

Tax season is just around the corner. Here’s what students need to know.

As tax season approaches, so is the stress for students who may be first-time filers.

What You Need to Know:

If you’re earning income in Canada, even as a student, the deadline for tax returns is April 30, 2024.

Most income you receive – including employment income, tips and occasional earnings, scholarships, research grants – is taxable.

To file a tax return, you need either a Social Insurance Number (SIN) or an Individual Tax Number (ITN). If you don’t have a SIN, head to Service Canada to see if you are eligible for one.

Common Kinds of Tax Forms:

A T4 slip is issued by employers showing the amount of gross pay received by employees before deductions.

A T2202A form is a tax receipt issued by qualifying educational institutions for tuition, education and textbook tax credits.

A T4A holds information regarding scholarships received during the year. If you are enrolled as a full-time student at a Canadian university, any amount received from scholarship, fellowships, bursaries, or grants – including the grant portion of OSAP – are non-taxable.

Do I Have to File a Return?

If you owe income tax to the government or are asked by the CRA to file a return, you must file a tax return. It’s also good practice because you might receive a tax refund or qualify for benefit payments from the government.

How Do I File My Taxes?

“First and foremost, we advise students to file with their parents. This benefits the family as a whole,” said Elizabeth Smith, Office Manager at M Smith Accounting Professional Corporation.

If this is not possible, Smith suggests meeting with the Tax Clinic at their school, or finding Community Volunteer Income Tax Programs in their area.

However, according to Laura Mezzanotte, a real estate corporate banking analyst with RBC, filing taxes on your own might be easier than you think.

“You can just go to the CRA website and fill it out there,” she said. “Everything is online now.”

Is It Actually That Big a Deal if I Don’t?

Yes, you have to file your taxes – all of them.

Not only could not filing your taxes put you in trouble with the CRA, filing them incorrectly could land you with additional fees to pay.

“Let’s say you miss a chunk of income and don’t report it, and the CRA somehow finds out later, you’ll still pay the taxes on that income plus an interest fee on top,” said Mezzanotte.

For more information, check here.

Layout and design by S Saadeq Ahmed

-

Crime2 years ago

Crime2 years agoToronto’s Massive Car Theft Problem, Explained

-

Government of Canada2 years ago

Government of Canada2 years agoMaple Leaf Millions

-

Finance2 years ago

Finance2 years ago“Not like anything we’ve ever seen before”: Reddit group plans Loblaw boycott

-

Jobs2 years ago

Jobs2 years ago“Shame on Bell”: Unifor stages rally in Ottawa to protest Bell Canada

-

Canadian Census Data and Trends2 years ago

Canadian Census Data and Trends2 years agoThinking of leaving the province? You wouldn’t be the first

-

Science2 years ago

Science2 years agoA “Cosmic Coincidence”: the Upcoming Solar Eclipse, Explained

-

Government of Canada2 years ago

Government of Canada2 years agoNEXUS Prices Set to Rise by Fall 2024

-

Government of Canada2 years ago

Government of Canada2 years agoFederal Carbon Tax Continues to Divide Canadians