Government of Canada

NEXUS Prices Set to Rise by Fall 2024

Canada Border Services Agency says that the new US$120 fee will help the program meet increased travel demand.

By IsoBelle O’Neill

In a move that may impact frequent travellers between Canada and the United States, government authorities are considering a significant increase in the NEXUS application fee. According to recent reports, the fee, which has remained at US$50 since the program’s inception in 2002, is slated to rise to US$120 effective October 1, 2024.

The decision to raise the fee stems from the need to adapt to the evolving demands and costs associated with the NEXUS program. Over the past two decades, the current fee structure has become inadequate to cover the expenses of administering the program and implementing necessary improvements.

The proposed fee adjustment, if approved, would align more closely with the actual cost of maintaining the program. It would translate to approximately US$24 per year for a five-year membership, reflecting the program’s operational expenses, including technology upgrades and infrastructure enhancements.

Since April 2023, the NEXUS program has witnessed a surge in applications, with over 510,000 submissions and nearly 10,000 interviews conducted every two weeks. This increase in demand necessitates a corresponding investment to sustain and enhance the efficiency of the program.

NEXUS, a trusted traveler program jointly operated by the Canada Border Services Agency (CBSA) and U.S. Customs and Border Protection (CBP), aims to expedite border crossings for pre-approved, low-risk travellers. With more than 1.8 million members, predominantly Canadian citizens, the program offers dedicated lanes at land crossings and expedited processing at airports, facilitating smoother travel experiences.

However, the proposed fee hike has sparked mixed reactions among the public. CP24, a prominent news outlet, recently released a Twitter post disclosing the impending change, prompting various responses from users.

One commenter expressed concern, stating, “That’s a huge hike when it does not replace a passport.” Conversely, another individual voiced willingness to pay more under certain conditions such as better application processing times, saying, “I’d be happy to pay more if it resources the program properly and reduces this to 10 or 20 days.”

In contrast, a supporter of the NEXUS program emphasized its value, stating, “and it’s worth every penny – I’d pay twice that for the convenience this card provides me.”

While the fee adjustment remains contingent upon regulatory approval in both Canada and the U.S., it underscores the ongoing efforts to ensure the sustainability and effectiveness of the NEXUS program in facilitating secure and efficient cross-border travel.

Government of Canada

Maple Leaf Millions

Canadian MPs now second highest paid worldwide despite 80 per cent public disapproval.

By Mehmet Oner

After the recent rise on April 1, Canadian MPs now rank second globally in earnings among politicians, yet 80 per cent of Canadians oppose politicians’ pay increases.

According to the House of Commons, MPs’ salaries are adjusted annually on April 1, aligning with the average percentage increase in the private sector’s base wages. This year, the adjustment corresponds to a 4.4 per cent increase.

Before April 1, MPs earned an annual salary of $194,600, but on April 1, that amount increased to $203,100, meaning an MP’s standard wage increased by $8,500.

Prime Minister Justin Trudeau’s total salary, which stood at $389,200 in 2023, has now risen by $17,000 to $406,200.

Conservative Leader Pierre Poilievre’s yearly earnings have also seen a $12,500 boost from $287,400 to $299,900.

The total pay for NDP Leader Jagmeet Singh and leaders of other parties increased by $11,300 to $271,700 this year, up from $260,400 in 2023.

The minister’s total pay rose to $299,900 this year, showing an increase of $8,500 from the $291,400 reported in 2023.

According to a Leger poll conducted by The Canadian Taxpayers Federation, 80 percent of Canadians are against raising the salaries of MPs. The online pool included 1,541 Canadian adults surveyed between Mar. 15 and 18.

CTF Federal Director Franco Terrazzano said in a release the poll results clearly show Canadians do not think their MPs deserve another pay raise. “It looks like the only Canadians who strongly support an MP pay raise are probably the politicians themselves.”

“The timing of the MPs’ salary increases on April 1, coinciding with the hike in the federal carbon tax, left me feeling like an April Fool,” said Ozzie Simsek, a resident and cleaning worker in the Halton region. “Amidst soaring inflation and tax burdens we face, I question the justification for granting MPs this raise,” he said.

According to data released by politicalsalaries.com, Canadian MPs come in second globally regarding political earnings after April 1, trailing only behind the United States.

Elected members of Congress in the United States receive an average annual salary of US$174,000 (approximately $236,433).

Following the United States, Canada’s MPs now receive a salary of $203,100, followed by members of the Israeli Knesset ($200,700), Australian MPs ($200,175) and parliamentarians in Singapore ($192,500).

Government of Canada

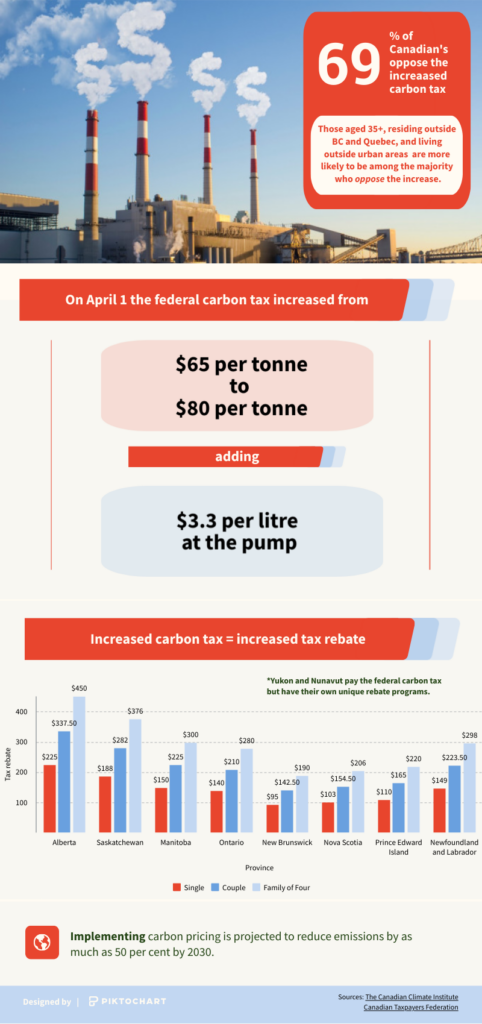

Federal Carbon Tax Continues to Divide Canadians

The federal carbon tax increase effective April 1 has been the source of much debate between its defenders and opponents.

The federal carbon tax increase effective April 1 has been the source of much debate between its defenders and opponents.

“This carbon tax has to go or in a year and a half, the prime minister is going,” said Ontario Premier Doug Ford at a news conference in East Gwillimbury, Ont., on Monday. “It’s as simple as that, he will be going, I’ll guarantee you.”

The federal government’s increase, from $65 per tonne to $80, will see drivers pay an additional 3.3 cents per litre at the pump. Since the Canadian government introduced the levy in 2019, the carbon tax has added 17.6 cents to the cost of a litre of gasoline.

Provincial leaders such as Newfoundland and Labrador Premier Andrew Furey had asked the federal government to put a pause on the increase. In a letter to Prime Minister Justin Trudeau posted on X, Furey says that the hike “is causing understandable worry as people consider how they will manage the mounting financial strain.”

Drew Spoelstra, president of the Ontario Federation of Agriculture, said that the tax takes money away from investing in clean farming technology.

“We support a clean environment but farmers just don’t have any alternatives,” he said at a news conference Tuesday. “We have to use fuel and energy to grow the food that we all eat.”

Trudeau defends federal carbon tax

In an announcement made in Ottawa on Monday, Trudeau said that although the price on pollution is increasing, so is the Canadian Carbon Rebate.

“It’s money in people’s pockets while we continue stepping up in the fight against climate change,” he said.

“So all those premiers that are busy complaining about the price on pollution but not putting forward a concrete alternative that they think would be better for their communities are just playing politics.”

The hike in the federal carbon tax will also mean an increase to rebate cheques. In Ontario, single-person households will receive $140 quarterly and a family of four will get $280 every three months.

An analysis from the Canadian Climate Institute, released in March, found that carbon pricing is projected to reduce emissions by as much as 50 per cent by 2030. The institute’s report says industrial carbon pricing is projected to contribute “between 23 and 39 per cent (or 53 to 90 megatonnes) of avoided emissions from all policies implemented to date.”

Written by Saadeq Ahmed.

Canadian Census Data and Trends

Thinking of leaving the province? You wouldn’t be the first

Why Canada is witnessing an increased uptake in interprovincial migration

Illustration created by Trent Weston using Runway’s AI software.

Article Written By: Katie Bell

Audio recording created with Speechify

A recent Statistics Canada report shows that interprovincial migration across Canada reached a record level high since the 1990s. The cost of housing, other living costs and job opportunities are the reasons for these shifts a source indicates.

The report shows that Ontario has lost the largest number of people in addition to British Columbia while provinces like Alberta have gained the most followed by Nova Scotia, New Brunswick and Prince Edward Island.

“We have the most affordable housing in all of Canada, pretty much, of any city,” Brian Jean, Alberta’s Minister of Jobs says to the CBC.

“So people now can, for instance, sell their house in Toronto or in Vancouver and buy four houses here in Alberta: live in one and rent three.”

Brian Jean, minister of jobs, alberta

The average housing price in Ontario is $873,207 and in British Columbia it is $987,789, almost double the average housing price in Alberta, Nova Scotia, New Brunswick and PEI as of February 2024, according to housing market data. Ontario and British Columbia also had the highest rental prices on average in March according to Rentals.ca.

“It’s clear that the two most expensive provinces have exceptionally high house prices, but general living costs tend to be higher too,” a spokesperson from Westland Insurance says in a Global News article.

A study conducted by Westland Insurance shows that British Columbia and Ontario are the top two provinces in Canada with the highest costs of living. This includes higher prices for goods like produce, transportation and dental care amongst other things as stated in a Toronto Sun article.

In 2022 and 2023, Alberta launched an “Alberta is Calling” campaign, aimed to attract workers from different populations to support their aging population. Teachers, healthcare workers and trades jobs were amongst some of the most-sought jobs, with the Alberta government promising them competitive wages.

Data visualization created by Adrian Ma

Nova Scotia’s job market has also increased as the province added 24,000 jobs during the years 2022 and 2023.

This rise in population growth is not all positive, however. Housing prices are continually on the rise and Alberta’s minister of social services is concerned that the province will soon face a housing crisis. Nova Scotia, New Brunswick and PEI are also facing housing shortages.

While people are leaving the province, Ontario and British Columbia’s population continues to increase according to Statistics Canada, and will therefore have limited impact on the economy as revealed in a report by Scotiabank.

With interprovincial migration having little effect on Ontario and BC’s economy, housing prices continue to surge across the country.

Former Statistics Canada Chief Statistician Anil Arora explains that Canada’s population reached over 40 million on June 16, 2023. There was an annual increase of over 1.2 million people between January 1, 2023 and 2024, the highest yearly growth rate since 1957.

-

Crime2 years ago

Crime2 years agoToronto’s Massive Car Theft Problem, Explained

-

Government of Canada2 years ago

Government of Canada2 years agoMaple Leaf Millions

-

Finance2 years ago

Finance2 years ago“Not like anything we’ve ever seen before”: Reddit group plans Loblaw boycott

-

Jobs2 years ago

Jobs2 years ago“Shame on Bell”: Unifor stages rally in Ottawa to protest Bell Canada

-

Canadian Census Data and Trends2 years ago

Canadian Census Data and Trends2 years agoThinking of leaving the province? You wouldn’t be the first

-

Tax Season2 years ago

Tax Season2 years agoNavigating Tax Season as a University Student

-

Science2 years ago

Science2 years agoA “Cosmic Coincidence”: the Upcoming Solar Eclipse, Explained

-

Government of Canada2 years ago

Government of Canada2 years agoFederal Carbon Tax Continues to Divide Canadians